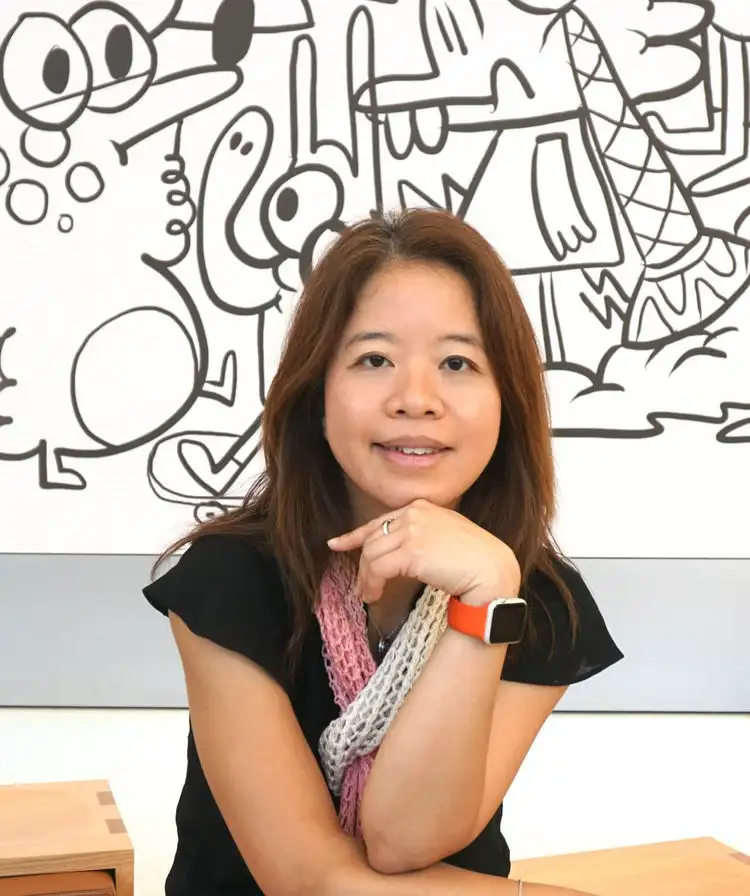

Theodora Lau Founder of Unconventional Ventures

THEODORA LAU FOUNDER OF UNCONVENTIONAL VENTURES Theodora Lau is the founder of Unconventional Ventures, a firm dedicated to supporting innovation that benefits traditionally underserved populations in finance. A passionate advocate for diversity, ethics, and inclusion in fintech, Lau has become a respected voice at the intersection of technology, policy, and social impact. Her writing regularly appears in top industry publications, and she co-authors ‘The Financial Revolutionist’ as well as her own newsletter ‘Fintech Prose.’ Lau is also the co-host of the podcast ‘One Vision,’ where she interviews innovators across fintech, healthtech, and digital transformation. With a background in technology and strategic development, Lau speaks frequently at global conferences and advises startups and corporates alike on building more inclusive and human-centered products. She is deeply involved in initiatives promoting financial health, ethical AI, and equitable access to services. Lau’s influence in fintech is unique: while she does not build or fund companies directly, she shapes the culture and conversation of the industry. Her commitment to purpose-driven innovation has helped shift the focus of fintech from growth-at-all-costs to sustainable, inclusive progress. As the industry matures, voices like hers are more critical than ever.